Not known Facts About Payment Hub

Wiki Article

Everything about Credit Card Processing

Table of ContentsLittle Known Questions About Payment Solutions.Some Ideas on Square Credit Card Processing You Need To KnowCredit Card Processing Fees Can Be Fun For AnyoneGetting The Payeezy Gateway To WorkA Biased View of First Data Merchant ServicesThe Only Guide to Fintwist SolutionsMerchant Services Things To Know Before You BuyCredit Card Processing Companies Fundamentals ExplainedLittle Known Questions About Fintwist Solutions.

One of the most usual grievance for a chargeback is that the cardholder can not keep in mind the deal. Nonetheless, the chargeback proportion is really reduced for transactions in an in person (POS) environment. See Chargeback Management.You don't require to come to be an expert, but you'll be a much better consumer if you know exactly how charge card processing in fact works. To comprehend exactly how the settlement process jobs, we'll take a look at the actors and their roles. That are the stars in a credit rating and debit card deals? gets a credit scores or debit card from an uses the account to spend for items or services.

How Credit Card Processing Fees can Save You Time, Stress, and Money.

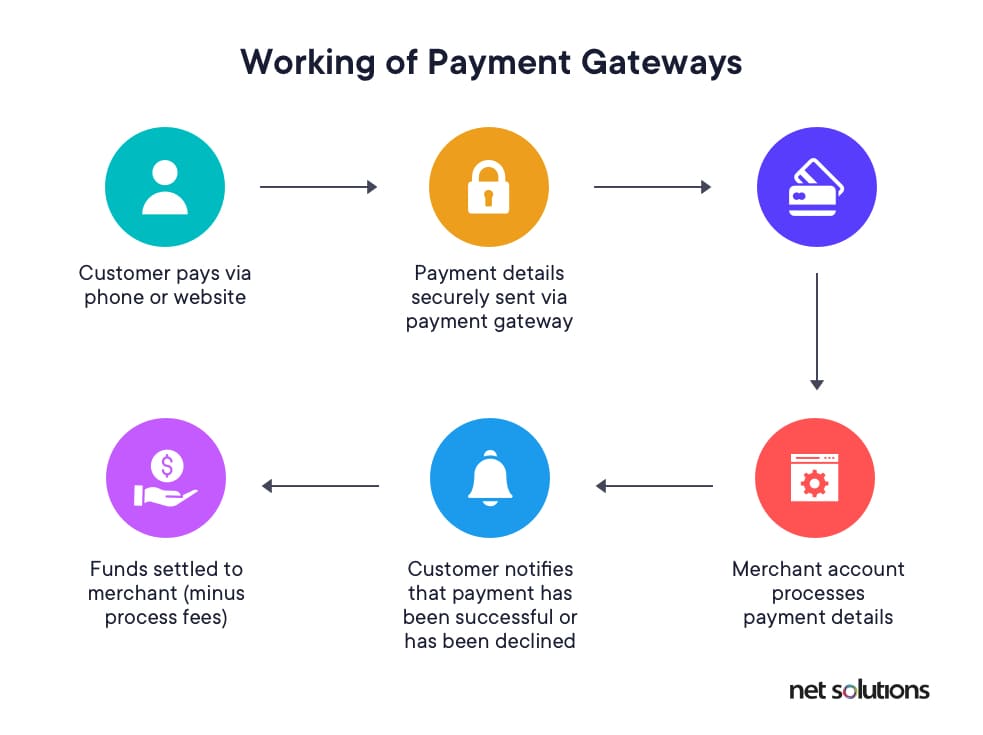

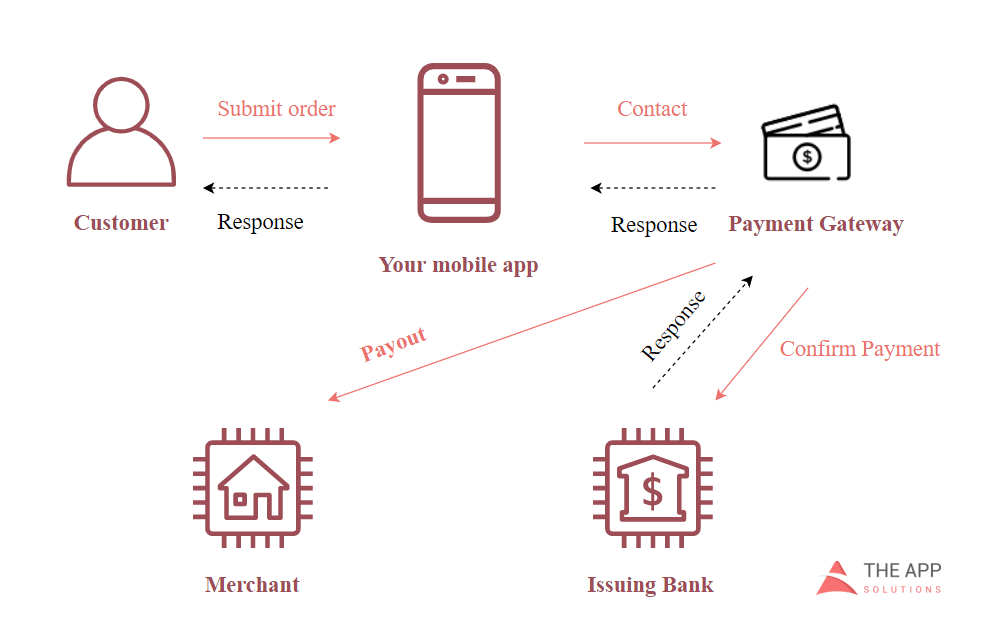

That's the bank card process basically. Now allow's take a look at. send sets of authorized purchases to their. The passes purchase information to the that connect the ideal debits with the in their network. The costs the make up the quantity of the deals. The after that transfers ideal funds for the purchases to the, minus interchange fees.

The Facts About Ebpp Revealed

You can obtain a seller account via a repayment handling firm, an independent specialist, or a huge bank. Without it, you would certainly have no place to maintain the cash your customers pay you. A payment processing business or banks manages the transactions between your clients' banks and your financial institution. They take care of such inquiries as bank card credibility, readily available funds, card restrictions, and so forth.You must allow merchants to access details from the backend so they can watch history of payments, terminations, and also other transaction data. Likewise, you have to follow the PCI Protection Criteria to give internet site repayment processing solutions for customers. PCI Safety assists vendors, vendors, and also banks implement criteria for producing safe settlement solutions.

The Single Strategy To Use For Comdata Payment Solutions

Pay, Buddy, as an example, is not subject to banking laws, so it can freeze your account and also for that reason your money at will (clover go). Other drawbacks include high rates for some types of settlement handling, restrictions on the variety of deals each day and amount per transaction, and safety and security openings. There's additionally a range of on the internet payment handling software application (i.

The smart Trick of Square Credit Card Processing That Nobody is Talking About

vendor accounts, sometimes with a repayment portal). These systems vary in their compensations and assimilation possibilities some software is much better for audit while some fits fleet management best. An additional option is an open source repayment processing platform. But do not think about this as complimentary processing. An open source system still needs to be PCI-compliant (which sets you back around $20k each year); you'll have to release it and maintain numerous nodes; and also you'll require additional hints to establish up a connection with an acquiring bank or a settlement cpu.Online Payment Solutions - Questions

They can also make your cash circulation more foreseeable, which is something that every small company owner pursues. Figure out more exactly how around B2B settlements function, as well as which are the best B2B repayment products for your small company. B2B payments are payments made between 2 sellers for goods or services.

Payment Solutions Can Be Fun For Everyone

Individuals entailed: There are several people involved with each B2B deal, consisting of receivables, accounts payable, invoicing, and procurement groups. Settlement hold-up: When you pay a close friend or member of the family for something, it's usually right on-site (e. g. at the dining establishment if you're breaking a more tips here costs) or just a few hrs after the occasion.In light of the complexity of B2B repayments, increasingly more businesses are choosing trackable, digital payment options. Fifty-one percent of organizations still pay by check, declining from 81% in 2004. As well as 44% of organizations still receive settlement by check, decreasing from 75% in 2004. There are 5 main ways to send and receive B2B payments: Checks This category consists of conventional paper checks as well as electronic checks issued by a buyer to a vendor.

What Does Credit Card Processing Fees Do?

Electronic bank transfers These are repayments between financial institutions that are routed with the Automated Clearing Up Residence (ACH). This is one of the safest as well as reputable repayment systems, however financial institution transfers take a couple of days longer than wire transfers.Payment credit card processing companies entrance A payment portal is an on-line repayment system that enables the buyer to spend for products or services online throughout the check out procedure. Each alternative differs in convenience of use for the sender and also recipient, price, as well as safety. That stated, many companies are shifting away from paper checks and also moving toward electronic and also digital payments.

The Ultimate Guide To Credit Card Processing Companies

Settlements software application as well as applications have reports that offer you a review of your balance dues and also accounts payable. For instance, if there a couple of merchants that frequently pay you late, you can either implement more stringent target dates or quit working with them. B2B repayment solutions likewise make it much easier for your clients to pay you, aiding you receive repayment much faster.Report this wiki page